Amazon in : trading indicator books

Contents

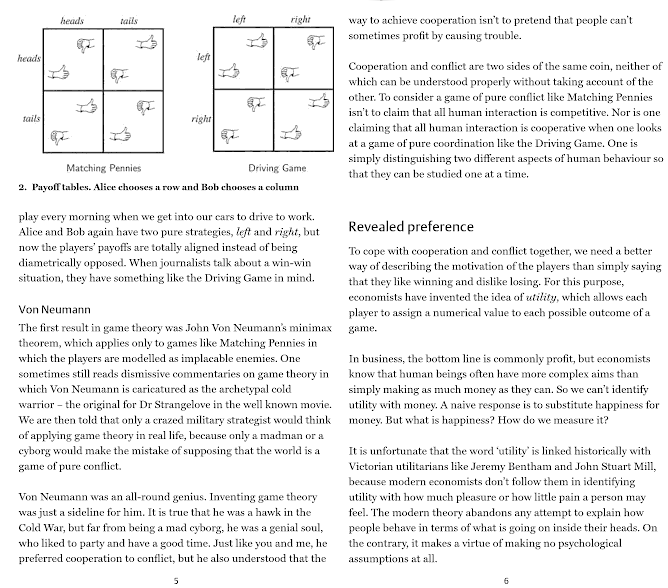

This means that an in-depth knowledge of the relevant indicators is mandatory. Further, if a trader scalps in the middle of a trusted trend, it is highly probable that your share market prediction is accurate. When an asset’s price moves outside the predefined area of resistance or support, a breakout occurs.

Depending on your trading strategy and the kinds of trades you wish to perform, you can find indicators that help you more than others. For instance, the best indicator for option trading may be an indicator which has no use in a short-term strategy, but one like the Relative Strength Index or Bollinger Bands. Another common indicator used by scalpers is the Moving Average Convergence Divergence Indicator or MACD. The Stochastic Oscillator indicator, also known as a momentum indicator is another popular indicator used for indices, forex, and CDFC trading.

Some volatile currency pairs are GBP/AUD, AUD/JPY. The prices of Gold and Silver also experience a considerable degree of variation during a trading session. Exiting a trade at the most favorable time decides the success of a trade. Thus, when you observe any of the following conditions being met, exit the trade accordingly. If the 50 SMA goes across the blue line of the 120 EMA to the downside, it is a sell indicator. It indicates that the market is going through selling pressure.

What is a ‘Technical Indicator’ and the Technical Analysis of Stocks?

It is an important trading benchmark that is plotted day wise, starting from the opening price and ending at the close price intraday. Scalping is the shortest-term trading method where investors use high trading volumes to make a profit rather than trying to increase profits for each trade. Scalping utilizes small constant price fluctuations and relies on small profits from each trade. However, the number of trades done is much higher, adding to the profits. For traders who want to utilize it as their primary technique or even those who use it to support other types of trading, scalping can be pretty successful.

But it is essential to note that they should be used with other technical indicators that help in identifying trends. 1 Minute Scalping Strategy is based on trend-following and mean-reversion which helps to bring to the minimum false signals. Though it doesn’t rule out the necessity of proper risk management strategy attached to it. As we mentioned, the best scalping strategies lean on the use of technical indicators including Bollinger Bands, Moving Averages, theStochastic Oscillator, parabolic SAR and RSI.

There are thousands of scalping indicators available to traders however the ones mentioned above are the most used and preferred indicators. The put call ratio helps the traders to understand whether a recent rise or fall in the market is excessive and decide if the time has come to take a contrarian call. This is why the put-call ratio is also known as a contrarian indicator.

This difference could be the impact of some news that was released before the market opened. This could result in a sizable move during after hours trading, and the stock picks up at this point when the normal trading day gets under way. Gaps are important because they create new support or resistance lines for the security. Traders set up sell orders using these support and resistance points as their stop loss or limit. If you’re new to trading, then you might want to start with a simpler strategy, such as the 5-minute scalping strategy. As you become more comfortable with scalping, you can slowly start to experiment with different strategies and timeframes.

Parabolic SAR Indicator

Short selling is a trading practice speculating on the fall in the price of a stock or other securities. It’s an innovative technique that only seasoned traders can take on. Position sizing points to the total number of units held by a trader in certain security. A trader’s risk-taking abilities and account size have to be necessarily considered by a financial planner or advisor when deciding on the position sizing.

Intraday traders act at a decent speed, which is not very high. They have the entire day session to wait and act on price levels of their choice. The high quantity of security balances off https://1investing.in/ the low price movement and enables the trader to book a good profit amount. Also known as ADX, this stock market indicator is used for assessing the legitimacy of any ongoing market trend.

- However, RSI combined with MACD is widely preferred by options trades.

- It is quite useful as it enables the traders to give more weightage to recent prices.

- Yet another popular indicator used by traders is the Moving Average Convergence Divergence or MACD indicator.

- The finest outcomes for scalpers come from profitable deals that may be repeated frequently throughout the day.

- Hence, the overbought and oversold levels need to be restored for every stock individually.

Price action is also important for analysts as it forms the basis of technical analysis of the stocks or commodities involved. Focusing on charts with shorter periods, such as the one-minute and five-minute candlestick charts, is therefore necessary. It is usual to practice utilizing momentum indicators like stochastic, moving average convergence divergence , and the relative strength index . Momentum indicators or MOM indicators are widely popular technical analysis tools used by traders to measure the rate at which the price of a stock fluctuates.

Scalping Strategy

You should note that common gaps are not placed in the patterns of prices. All they do is represent a place where the price of a stock has gapped. There is such a phenomenon as continuation gaps and these can occur in the midst of a price pattern. They signal a rush of sellers or buyers who share a universal belief about the future direction of an underlying stock. In the simplest terms, gaps refer to a price range during which no shares have changed hands. Then, you will find that the stock price rises over the former peak and forms a “nose”.

When %D crosses overbought plot and %K crosses below %D, then you ought to sell. When %D remains below oversold and %K comes above %D, then it is suggested that you buy. Further, any upcoming trend is declared to have strength in case the ADX ranks above 25.

Trading in the options segment is tricky anyway, and using scalping to earn profits requires discipline, decisiveness, discipline, and analytical prowess. You must be very clear while choosing a strategy to avoid any hassles. Following a strategy never guarantees the success of all the trading positions, but it certainly helps you succeed in a majority of the trades.

Such traders generally trade with a strict, pre-planned exit strategy since a single massive loss can most likely eliminate their many small gains, obtained with hard work. Moving average is a tool used by investors and traders in technical analysis, to evaluate the movement of the asset’s prices and trend direction of the securities. In a way the moving average is a nyse vs nasdaq tool that helps the investors and traders to keep in pace with the trends of the market. The question that any traders often ask themselves is whether technical indicators and fundamental analysis are reliable in the market. Technical analysis is done on the basis of the reading of market sentiments, using patterns on graphs, as well as certain signals of trading.

scalping

Therefore, the trader must have the most suitable tools to avoid missing out on any profitable opportunity just because of a scarce resource. The methodology is a close approximation of the one described in his book Mastering the Trade. Note the squares are not real-time but will show up once the third bar has confirmed a reversal. Even though both are Intraday trading, the core fundamentals are quite different from one another. So, if you are a trader, you can guess the tentative movement prior to what really will happen using the Stochastic Oscillator indicator.

MACD Indicator

The SAR scalping indicator functions best when markets show consistent tendencies. The above image shows the example of a long trade under a 1-min scalping strategy. To do this, you’ll need to use a very short-term moving average, such as a 5 EMA and 50 EMA. Some are more effective than others, and some are better suited for certain types of markets. The dots placed below the price bar depict a bullish trend, which means the trader should open a long position.

Are Indicators in the Stock Market Useful?

Exponential moving average – gives more weight to recent prices, making it more responsive to new information. Next, have to calculate the multiplier for weighting the EMA which – [2/(selected time period + 1)]. Bollinger Bands is used to indicate areas of market volatility. Bollinger Bands rely on a simple moving average with a standard deviation set above and below to show how volatile a market might be. Traders believe that wider standard deviations indicate increased volatility in and vice versa, if the bands are narrow it might mean that the market is stable.

To make the right use of this, it is important to know best EMA for intraday and scalping. To find out these levels, you don’t need to carry out any detailed analysis. In fact, most of the Forex news websites publish the three resistance and support levels . Support and resistance of the corresponding financial security.

Declines to the original price will happen next, and then the stock price will increase to the level of the first peak. You tend to see this pattern when a bullish to bearish trend reversal is going to happen. Additionally, because scalpers hold their positions for such a short time, they must be very quick and agile in their execution. This can be difficult, especially for new traders who are still learning. A confused trader might have to incur losses and lose out on many fantastic opportunities to maximize profits. Thus, below is a list of the few most commonly used scalping strategies futures.